Central Bank of Nigeria’s coercive tactics for CBDC adoption are similar to those applied by governments with vaccine passports, digital ID: perspective

By limiting cash withdrawals, the Central Bank of Nigeria (CBN) is further eroding the ability to transact anonymously as it pushes the eNaira Central Bank Digital Currency (CBDC).

Launched in October, 2021, Nigeria’s CBDC has seen an abysmal adoption rate, with less than 0.5% of the population using the eNaira.

On Tuesday, Nigeria’s central bank instructed the country’s banks and other financial institutions to limit the amount of cash that individuals and organizations could withdraw both daily and weekly, while “encouraging” digital channels, such as the eNaira, which also has caps on daily transaction limits.

“Customers should be encouraged to use alternative channels (internet banking, mobile banking apps, USSD, cards/POS, eNaira, etc.) to conduct their banking transactions” — Central Bank of Nigeria, December 2022

Beginning January 9, 2023, over the counter weekly cash withdrawals will be limited to $225 (100,000 naira) for individuals and $1,124 (500,000 naira) for corporate organizations.

According to the CBN, “Withdrawals above these limits shall attract processing fees of 5% [for individuals] and 10% [for corporate organizations].”

Additionally, ATM and point of service withdrawals will be limited to only $45 (20,000 naira) per day.

According to the CBN, “Customers should be encouraged to use alternative channels (internet banking, mobile banking apps, USSD, cards/POS, eNaira, etc.) to conduct their banking transactions.”

But even the eNaira has different caps on daily transaction limits!

“The individual and merchant wallets of the eNaira have different caps on daily transaction limits and the amount of eNaira that can be held in them” — Central Bank Digital Currencies in Africa, BIS, November 2022

Today: "CBDC can allow gov agencies & private sector players to program/allow targeted policy functions (i.e. consumption coupons) By programming #CBDC the money can be precisely targeted for what kind of people can own & what kind of use this money can be utilized" Bo Li, #IMF pic.twitter.com/kcROTxXZau

— Tim Hinchliffe (@TimHinchliffe) October 14, 2022

According to the Bank for International Settlements (BIS) November report on CBDCs in Africa, “The individual and merchant wallets of the eNaira have different caps on daily transaction limits and the amount of eNaira that can be held in them, depending on their customer due diligence tier.”

Why are people being restricted on how much money they can hold and spend on a daily basis?

The official reason is that “The caps are intended to ensure that the eNaira is primarily used for smaller retail payments and that competition between eNaira and bank deposits is limited.”

Cashless Nigeria “aims at reducing (NOT ELIMINATING) the amount of physical cash (coins and notes) circulating in the economy, and encouraging more electronic-based transactions” — Central Bank of Nigeria, 2012

The move to reduce the amount of cash people can withdraw is part of the 2012 “cashless policy of the CBN,” that “aims at reducing (NOT ELIMINATING) the amount of physical cash (coins and notes) circulating in the economy, and encouraging more electronic-based transactions (payments for goods, services, transfers, etc.).”

However, a World Economic Forum (WEF) Agenda blog post from September, 2017 lists the “gradual obsolescence of paper currency” as being “characteristic of a well-designed CBDC.”

And by “encouraging more electronic-based transactions” like the eNaira, the Nigerian central bank is further eroding the ability to transact anonymously, as well as making customers declare why they are withdrawing cash.

According to Tuesday’s directive, Nigerian banks and other financial institutions will be required to obtain and upload their customers’ personal information to the CBN portal, including:

- Valid ID of the payee (National ID, International Passport, Driver’s License)

- Bank Verification Number

- Notarized customer declaration of the purpose for the cash withdrawal

Additionally, “Compliance with extant AML/CFT [Anti-Money Laundering / Combating the Financing of Terrorism] regulations relating to KYC [know your customer], ongoing customer due diligence and suspicious transaction reporting etc. is required in all circumstances.”

“Users of eNaira are subject to a tiered structure of KYC requirements based on transaction and balance limits” — Central Bank Digital Currencies in Africa, BIS, November 2022

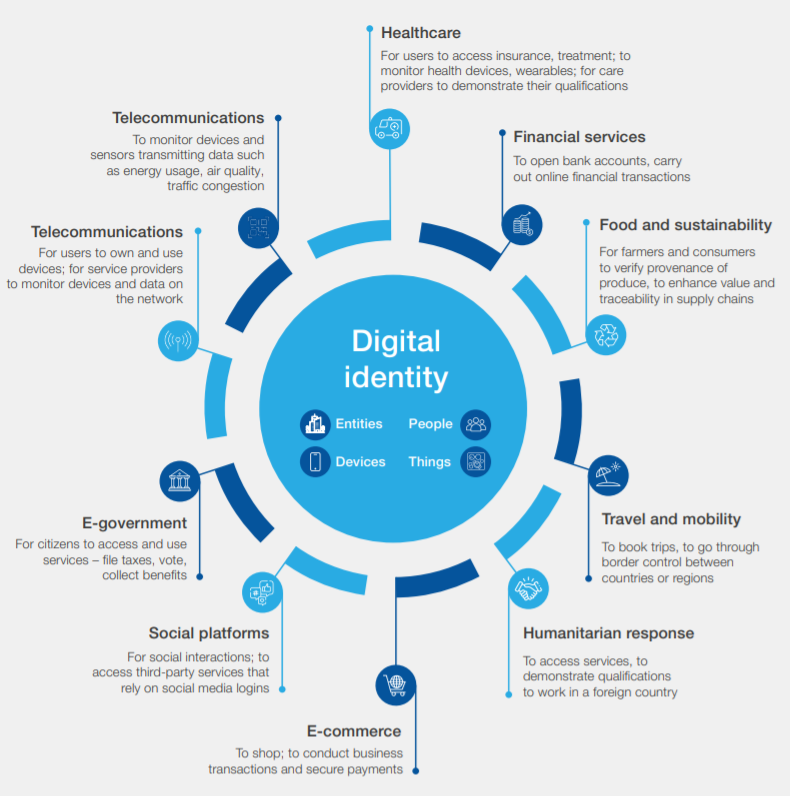

When central banks talk about KYC in the context of CBDC, they are talking about a customer’s identity, more specifically, a digital identity.

According to McKinsey, “KYC rules require banks to verify the identity of individuals opening an account. Institutions can use digital ID to expand their customer base rapidly and cost-effectively by using digital ID to comply with these requirements.”

The BIS November report on CBDCs in Africa also highlights, “An eKYC-enabled CBDC that is integrated with the national ID schemes could greatly ease financial onboarding.”

In the case of Nigeria, the BIS report adds, “Users of eNaira are subject to a tiered structure of KYC requirements based on transaction and balance limits.”

And, “When it comes to anonymity, the CBN has opted to not allow anonymity even for lower-tier wallets.”

The decision to not allow anonymity comes despite knowing that in Africa, “the informal sector – where most employment is in the continent favors the anonymity of cash.”

“Universal access to eNaira is a key goal of the CBN, and new forms of digital identification are being issued to the unbanked to help with access” — Central Bank Digital Currencies in Africa, BIS, November 2022

Digital ID is one of the mechanisms by which the Central Bank of Nigeria wants to achieve universal access to the eNaira, which is being carried out in the name of financial inclusion and helping the unbanked.

According to the BIS report, “Universal access to eNaira is a key goal of the CBN, and new forms of digital identification are being issued to the unbanked to help with access.”

A CBDC linked with digital ID can allow governments and corporations to put permissions on what you can buy with your own money, including expiration dates on when you can spend it.

“This digital identity determines what products, services and information we can access – or, conversely, what is closed off to us” — World Economic Forum, Insight Report, September 2018

Ultimately, the move to put caps on cash withdrawals in favor of digital services means that anonymous transactions are slowly fading away and are giving rise to fully traceable and programmable CBDCs that require some form of digital identity to operate.

“This digital identity determines what products, services and information we can access – or, conversely, what is closed off to us,” according to a 2018 report from the WEF.

The coercive tactics that the Central Bank of Nigeria have taken in limiting cash withdrawals in order to push a fully programmable CBDC with digital ID are similar to those that governments around the world imposed on their citizens with vaccine passports, which are another form of digital ID.

The end result is always the same — more power to public-private entities and less freedom for the people.