Bank for International Settlements (BIS) General Manager Agustin Carstens calls for a “unified programmable ledger in a public-private partnership” to unify Central Bank Digital Currencies (CBDCs), tokenized deposits, and fast payment systems.

Giving a keynote speech at the Monetary Authority of Singapore (MAS) on February 22, Carstens said that in order to fully realize the potential of new financial technologies like CBDCs, tokenized deposits, and fast payments systems, “We need some way to bring them all together.”

“There is great promise in developing the idea of a ‘unified ledger’ with a common programming environment.

“A unified ledger is a digital infrastructure with the potential to combine the monetary system with other registries of real and financial claims.

“It would need to be a public-private partnership with a clear division of roles, and where the central bank is tasked with underpinning the trust in money.”

Agustin Carstens, 2023

Programmability is a key feature of CBDC, meaning central banks and their customers could have total control over when, where, and how the money is spent.

According to the BIS Annual Economic Report 2022, “New capabilities such as programmability, composability and tokenization are not the preserve of crypto, but can instead be built on top of central bank digital currencies.”

The report goes on to say that “industry could benefit from CBDCs, which could underpin a decentralized system, by enabling regulated financial institutions to issue programmable money.”

Speaking at a high-level roundtable on CBDC in Washington, DC in October 2022, International Monetary Fund (IMF) deputy managing director and former People’s Bank of China (PBoC) deputy governor Bo Li explained how CBDCs could be programmed to determine what people could own.

“CBDC can allow government agencies and private sector players to program — to create smart contracts — to allow targeted policy functions. For example, welfare payment; for example, consumption coupons; for example, food stamps.

“By programming CBDC, those [sic] money can be precisely targeted for what kind of people can own and what kind of use this money can be utilized.”

Bo Li, 2022

Today: "CBDC can allow gov agencies & private sector players to program/allow targeted policy functions (i.e. consumption coupons) By programming #CBDC the money can be precisely targeted for what kind of people can own & what kind of use this money can be utilized" Bo Li, #IMF pic.twitter.com/kcROTxXZau

— Tim Hinchliffe (@TimHinchliffe) October 14, 2022

The notion of programmability was also raised by Bank of Russia deputy governor Alexey Zabotkin, who spoke at the annual cybersecurity training exercise Cyber Polygon back in 2021.

There, Zabotkin explained:

“This [digital ruble] will permit better traceability of payments and money flow, and also explore the possibility of setting conditions on permitted terms of use of a given unit of currency[…]

“Just imagine that you are able to give your kids some money in digital rubles and then restrict their use for purchase of junk food, for example.

“That would be a useful functionality for a customer, and of course you can come up with hundreds of other similar use cases.”

Alexey Zabotkin, 2021

Speaking of similar use cases, the Reserve Bank of India recently announced that it was exploring digital rupees that could be programmed with an “expiry date, by which they would need to be spent, thus ensuring consumption.”

Meanwhile in Nigeria, the central bank has put caps on daily transaction limits and the amount of eNaira that can be held.

ICYMI: In a keynote speech at @MAS_sg, Agustín Carstens argued that central banks need to have a big vision to reap the greatest benefits from innovation for the future monetary system #Innovation #CentralBanks Read more at https://t.co/RxteisVeZI pic.twitter.com/8bm8zq8CvF

— Bank for International Settlements (@BIS_org) February 22, 2023

There is great promise in the idea of a #UnifiedLedger, a platform combining different new functions with payments, which could boost the capacity of the monetary system and enable new forms of money that might do more than just pay

— Bank for International Settlements (@BIS_org) February 22, 2023

Central banks are actively working towards a monetary system that embeds the best of new technology into the solid foundations of the current two-tier structure pic.twitter.com/qfIJsshABC

— Bank for International Settlements (@BIS_org) February 22, 2023

Speaking at an International Monetary Fund (IMF) seminar on October 19, 2020, Carstens explained that a CBDC gives the central bank both “absolute control” over the use of the CBDC, along with the technology to enforce that control.

Carsten explained in 2020:

“We tend to establish the equivalence with cash, and there is a huge difference there.

“For example, in cash we don’t know for example who’s using a 100 dollar bill today. We don’t know who is a 1,000 peso bill today.

“A key difference with a CBDC is the central bank will have absolute control on the rules and regulations that will determine the use of that expression of central bank liability, and also, we will have the technology to enforce that.

“Those two issues are extremely important, and that makes a huge difference with respect to what cash is.”

Agustin Carstens, 2020

Now compare what Carstens told the IMF in 2020 with what he just told the MAS last week:

“It is clear that CBDCs and tokenized deposits do not represent new types of money. Instead, they replicate existing forms of money in a technologically superior way.”

In 2023 Carstens is making the case for programmable money, with a unified programmable ledger run by public-private partnerships.

According to Carstens:

“Such a ledger allows for the use of smart contracts and composability. A smart contract is a computer program that executes conditional ‘if/then’ and ‘while’ commands.

“Composability means that many smart contracts, covering multiple transactions and situations, can be bundled together, like ‘money lego.’

“With these new functionalities, any sequence of transactions in programmable money can be automated and seamlessly integrated.”

Agustin Carstens, 2023

Public-private collaboration is the modus operandi of the unelected globalists at the World Economic Forum (WEF).

It is the merger of corporation and state where the line between the two can become blurred as to who’s really calling the shots.

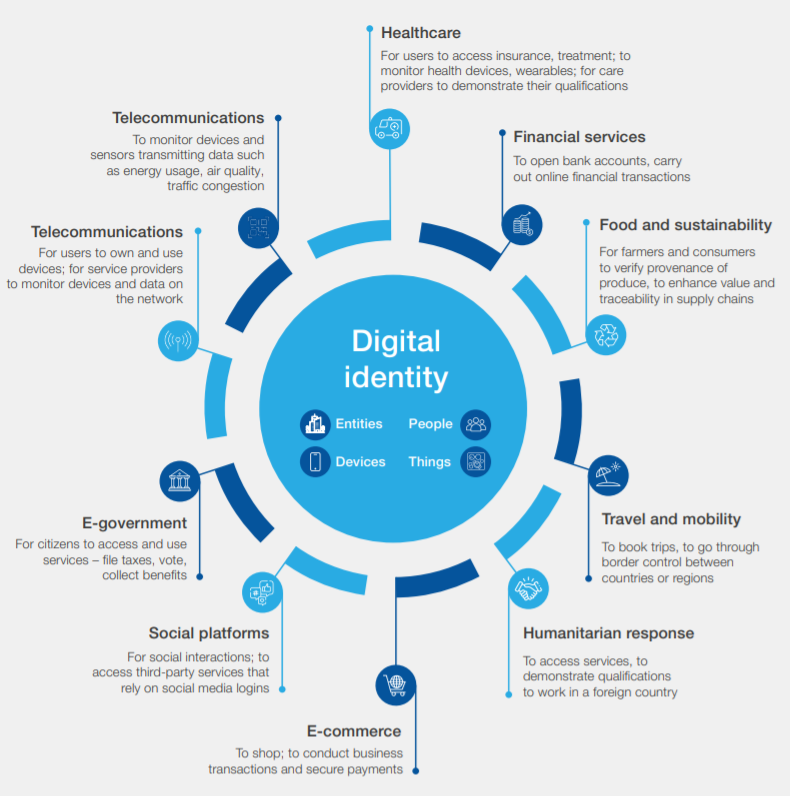

And what unelected globalist agenda would be complete without some form of digital identity?

"Digital identity verification is essential to the operation of CBDCs, particularly in cross-border transactions. Tradeable digital assets must be tied to a digital identity system" – @WorldBank, November 2021https://t.co/0iVmm88lPO pic.twitter.com/d8JpkAiSpk

— Tim Hinchliffe (@TimHinchliffe) October 15, 2022

As central banks all over the world opt to eliminate total anonymity in their CBDC considerations, the idea is to peg everyone’s financial behavior to a digital identity scheme.

“Identification at some level is hence central in the design of CBDCs. This calls for a CBDC that is account-based and ultimately tied to a digital identity.”

Bank for International Settlements, 2021

“By drawing on information from national registries and from other public and private sources, such as education certificates, tax and benefits records, property registries etc, a digital ID serves to establish individual identities online”

Bank for International Settlements, 2021

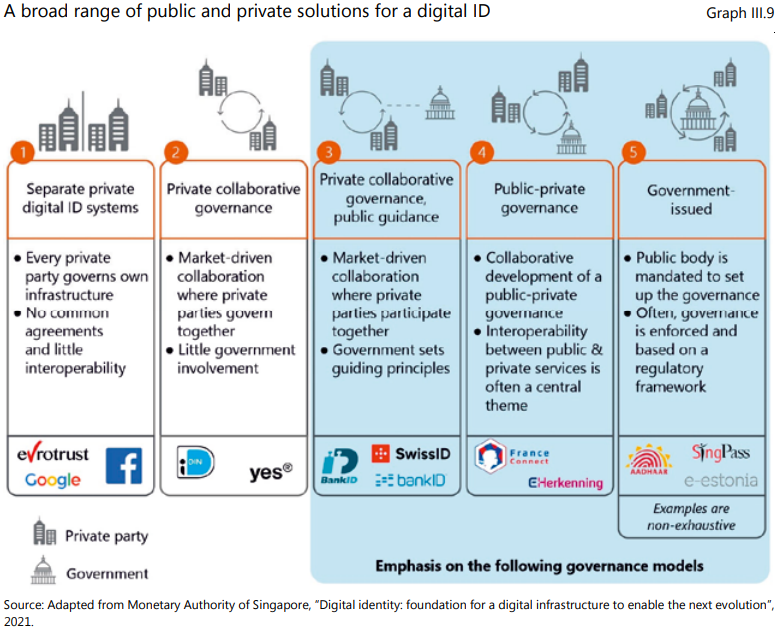

To get a clearer understanding of which entities could be in charge of handling digital identity schemes related to CBDC, the Bank for International Settlements (BIS) annual economic report for 2021 highlighted five scenarios using public and private entities (see image above):

- Separate Private Digital ID Systems

- Private Collaborative Governance

- Private Collaborative Governance, Public Guidance

- Public-Private Governance

- Government-Issued

According to the 2021 BIS report:

“A digital identity scheme, which could combine information from a variety of sources to circumvent the need for paper-based documentation, will thus play an important role in such an account based design.”

Bank for International Settlements, 2021

For the BIS, this digital identity would draw on “information from national registries and from other public and private sources, such as education certificates, tax and benefits records, property registries, etc.”

For the unelected globalists at the WEF, “This digital identity determines what products, services and information we can access – or, conversely, what is closed off to us.”