By Naked Emperor via nakedemperor.substack.com

Before I start this article, see if you can spot the difference between the two Bank of England (BoE) logos below. They both feature Britannia who has appeared on coins since Emperor Hadrian first minted coins featuring provincial figures. The one on the left was in use until recently when it was replaced with the one on the right in March this year.

You have probably spotted a number of differences, the colour has changed, the flag on the shield has changed to the Union Jack and the olive branch seems to have withered (a sign of the times!?) But one of the major changes is that the coins by Britannia’s feet have disappeared. The BoE explain this by saying:

The ostentatious pile of coins has been removed, as we don’t issue coins.

Or is this a signal that the era of cash is coming to an end?

Central Bank Digital Currencies

It has been clear for a while now that Rishi Sunak wants to introduce Central Bank Digital Currencies (CBDCs). He announced his intentions whilst Chancellor of the Exchequer, last year.

Again, whilst Chancellor, Mr. Sunak addressed delegates at COP26 to highlight his intentions to make the UK the world’s first net zero finance centre. “A clear common purpose…to direct the world’s wealth to protect out planet…We want to rewire the entire global financial system for net zero”.

'We want to rewire the entire global financial system for net zero'

Chancellor Rishi Sunak addresses delegates at the COP26 summit, pledging to make the UK the world’s first net zero finance centre. pic.twitter.com/Vce6rNC3rZ

— GB News (@GBNEWS) November 3, 2021

Since then the new WEF King appointed him as the WEF Prime Minister, the public had absolutely no say in who the new leader of the country was.

Together with the new WEF Chancellor, Jeremy Hunt (put into place during the coup removing Liz Truss), Rishi Sunak has reversed almost every policy that the Tory’s were voted in on.

Rishi Sunak recently explained the CBDCs in Unlock Media.

He explained that the Central Bank digital currencies could be a digital version of money, a bit like a digital banknote that could be used alongside physical notes and coins.

Unlike most of the digital money people use daily today, it would be issued directly by a central bank like The Bank of England in the UK.

He added that governments and central banks across the world are working together, looking into what having a digital currency might mean in practice, which includes issues that people care about, such as energy efficiency, availability and ensuring the safety and security of the user’s money.

Edinburgh Reforms (Ed-in-bu-ruh for you Americans!)

What this really means is the banks will have the ability to access and gamble with more of your money. Since the 2008 financial crisis, retail banks were forced to separate retail banking from investment operations, but these rules are likely to now be relaxed again.

As part of these reforms, Mr. Hunt reiterated that the UK wants to be a world leader in sustainable finance.

“The government is ensuring that the financial system plays a major role in the delivery of the UK’s Net Zero target, and is acting to secure the UK as the best place in the world for responsible and sustainable investment.”

To be able to do this, according to the Chancellor, the financial sector has to be at the forefront of technology and innovation. They want to regulate stablecoins but are also “consulting on a UK retail bank digital currency alongside the Bank of England in the coming week”. A sovereign digital pound.

This isn’t out of the blue, of course. They have been working on this for a while but don’t worry:

The project is purely experimental and does not reflect any intentions by the Bank of England on CBDC policy, design or launch.

Which as we all know means the BoE are planning on launching a CBDC.

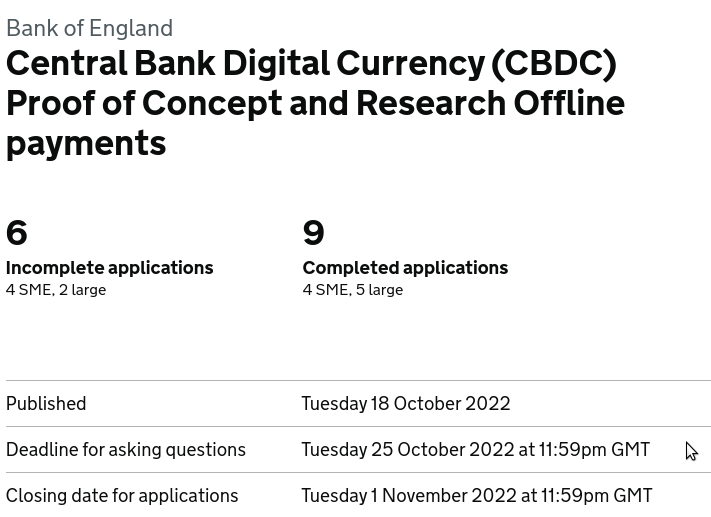

On 18 October 2022 they put out a request for applications to assist with offline payments.

Offline payments are a stumbling block to CBDCs because there is a risk of double spend when you aren’t connected to your network or wi-fi.

Then, on the same day as the Edinburgh Reform announcement, the BoE requested Proof of Concept for CBDC Sample Wallets.

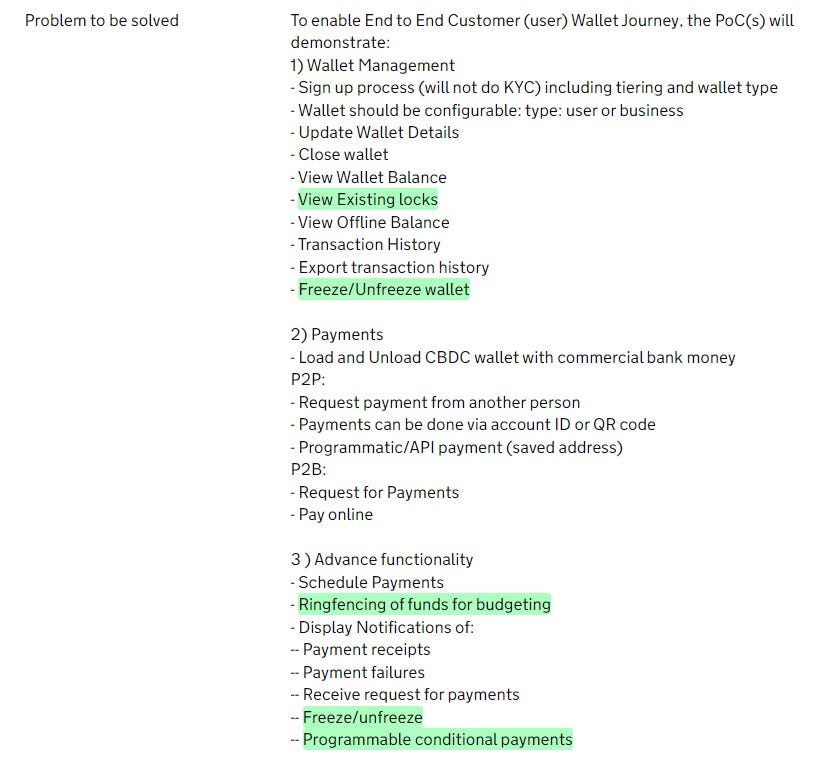

A wallet will hold all your lovely, hard-earned digital currency. But what else might it do?

Problems that they want solving are how to view locks on your wallet, how to freeze/unfreeze your wallet, how to ringfence funds for budgeting and how to programme conditional payments.

Why would the wallet which contains your money ever be locked, frozen, ringfenced or programmed? Well, as we’ve seen with the Canadian trucker protests, if you are doing something the government doesn’t like, they can freeze your bank account.

And as I’ve highlighted with the incoming sustainability nudging, your wallet could be ringfenced or programmed to only purchase things deemed to be suitable for the Net Zero agenda.

As we’ve seen recently in some African countries, the amount you can use each day could be restricted. Or your hard-earned ‘cash’ could have a time-limit on it, so that the central banks can stimulate the economy when it needs to.

But there is even more to this story.

Project Rosalind

A joint experimentation with the Bank of England, Project Rosalind aims to develop prototypes for an application programming interface. Based on a two-tier distribution model (central bank at the foundation of the retail CBDC system and customer-facing activities carried out by the private sector), the objective is to explore how this interface could best enable a central bank ledger to interact with private sector service providers to safely provision retail payments.

It will also explore some of the functionalities required to enable a diverse and innovative set of use cases to be developed by the private sector. Through this experimentation, the project aims to study how best to lay the foundation for building a robust and vibrant ecosystem.

So it seems the BoE aren’t alone in their CBDC desires. It looks like the BIS, in conjunction with the BoE, are developing a system for all central banks around the world to use.

But does it get even more sinister than that? As I’ve pointed out previously – “Rishi Sunak’s father in law, Narayana Murthy, is an Indian billionaire and founder of Infosys. In 2005 Narayana was co-chair of the WEF’s annual event, along with Bill Gates. Infosys has partnered with the WEF to deliver digital services which to many look like social credit systems and biometric IDs.”

Will these CBDCs incorporate biometric IDs? Why is the project named ‘Rosalind’ and why does it use a strand of DNA on its logo?

The project is named “after British scientist Rosalind Franklin, whose work was key to understanding DNA sequencing”. It seems an odd link for something to do with money. Is this an indication that CBDCs will be linked with biometric IDS?

Bank for International Settlements

This guy from the BIS tells you exactly what CBDCs are about – “absolute control”.

Interestingly, one of the Bank of England's stated reasons behind a CBDC Wallet is to “support the Bank’s work towards the BIS Innovation Hub’s ‘Project Rosalind’”.

Yes, the same BIS whose general manager said that central banks will have "absolute control” through CBDCs. pic.twitter.com/czFkZzIqE3

— BigTechtopia (@bigtechtopia) December 12, 2022

And before I end this article, who exactly are the BIS? This secretive organisation regularly meets in private to influence central banks around the world. As it is unaffiliated to any government is is immune from banking regulations and international laws. It is located in neutral Switzerland, in Basel and so its HQ is nicknamed the Tower of Basel due to its similarity with the Tower of Babel in the Bible.

This Harvard article summarises a book about the BIS by British journalist Adam LeBor called “The Tower of Basel: The Shadowy History of the Secret Bank that Runs the World”. I recommend your read the whole article to see how the bank was established but a snipped is below.

He devotes a great deal of Tower of Basel to an episode which, though highly controversial at the time, is often overlooked by history. After Germany annexed the Sudetenland province of Czechoslovakia in 1938, Czechoslovakian leaders transferred much of the country’s gold to two accounts at the Bank of England for safekeeping, LeBor writes. One account was in the name of the BIS and another was in the name of the National Bank of Czechoslovakia itself.

In early 1939, German officials demanded Prague hand over 14.5 metric tons of gold, supposedly to back Germany currency now circulating in the Sudetenland. In essence, LeBor notes, Berlin was demanding Czechoslovakia “supply the gold to pay for the loss of its territory.”

A month later, Germany invaded Prague and Czechoslovakia ceased to exist. Three days later, the Reichsbank demanded the National Bank of Czechoslovakia order the gold in its BIS account transferred to Germany. They were also ordered to request the Bank of England transfer the 27 metric tons of gold in the National Bank of Czechoslovakia account there to Germany.

“The BIS transfer order went through,” LeBor writes. He adds that “Nazi Germany had just looted 23.1 metric tons of gold without a shot being fired.”

The Bank of England did refuse to transfer the gold in the National Bank of Czechoslovakia account there. Nevertheless, the BIS transaction gave the Third Reich a new source of funding with which to finance its war effort.

The process was repeated throughout the war years, as Germany used plundered wealth to stoke its war machine. Accompanying the looting of central bank assets were proceeds from the “Aryanization” of Jewish-owned businesses that were stolen from their owners. Meanwhile, Germany gained ever greater influence at the BIS, leading to the completely reasonable assumption that it had a firmly pro-Nazi slant.