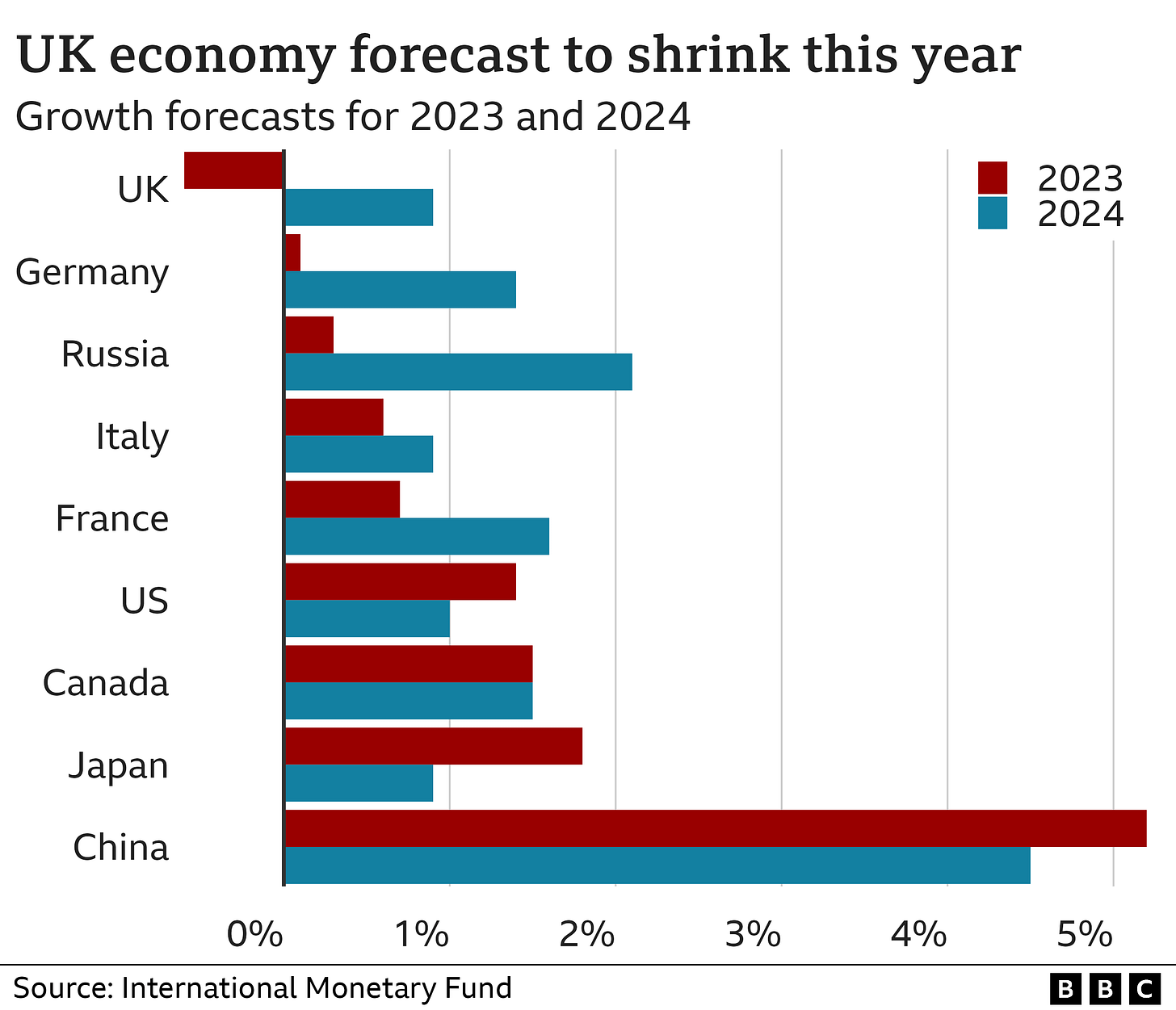

Today, the IMF downgraded the UK’s 2023 growth forecast by more than any other G7 nation. Many MSM headlines state that the UK will suffer more than sanction-hit Russia. Shock!

Why is this? Lockdowns, borrowing and policies are major factors but so is the UK’s over-reliance on the financial sector.

Most people gush over how great the City of London is and how much wealth it brings to the country but the reality is very different.

Learning about how banks operate and where money comes from was an eye-opener to me. I properly delved into the mechanics of it all during the Great Financial Crash in 2007/2008. I wondered why I had never been taught this stuff at school or university. Even worse, why did 99% of City workers not understand the system they were participating in!?

In the video interview below, Professor Richard Werner does a great job at explaining what happens in the banking system, why it is destructive and what needs to change. Topics covered include:

- What deposits really are;

- What loans really are;

- How money is created out of thin air;

- How this creates asset bubbles and inflation; and

- What regulations are required to stop this.

I have summarised his main points below and the video is at the bottom of the page.

Private debt in the UK (as a percentage of GDP) never went above 50% and remained relatively flat until Thatcher came into power in 1979. It then rose to almost 200% before the Great Financial Crisis in 2008.

GDP is calculated by adding up value-added activities. This is the problem with the financial sector – what is the value added? It is so difficult to work out the value added by the financial sector that a fictional value is made up and added onto GDP. The difficulty in calculating the figure is because essentially there is no value added, only value extracted and so in reality, it should be deducted from GDP.

Textbooks show banks as financial intermediaries, however the problem is we pay a high price for these services. Furthermore, people working within the banking sector earn very high salaries for something that should just be an intermediary service.

There is a structural problem, especially in the UK, with the concentration of the banking sector. In the UK, five banks account for 90% of deposits which is one of the most concentrated banking systems in the world. In Germany, that figure is 12% and 70% of deposits are accounted for by 1,500 small, local, not-for-profit banks.

When corporations get too big, too many decisions are made without accountability and the temptations of power strike. Large banks focus on large customers and large deals so that they can get large bonuses. What is needed in the UK is decentralisation and the creation of small, community banks which can be held accountable.

To produce something, you need funding and so banks have a role within the economy but the general public need to understand that banks aren’t really just intermediaries.

In reality, banks are creators of the money supply. They create money out of thin air. Most people think of banks as deposit taking institutions that lend money but the legal reality is that this is false. A deposit is not a bailment and is not held in custody. Legally, when you put money in the bank, it is not a deposit but simply a loan to the bank. The banks borrow from you the general public.

Banks don’t lend money either. Instead they purchase securities. If you sign a loan or mortgage contract with the bank you issue a security, namely a promissory note and the bank purchases that.

This is very different to what the banks present to the public.

So the bank purchases your promissory note but how do you get your money? No money is transferred, instead you will find the requested sum in your account. This is because, as mentioned above, what we all think of as deposits are actually the banks record of its debt to the public. Therefore, the record of what the bank owes you, is all you are getting when you receive a loan from them.

That is how the banks create the money supply. 97% of the money supply is created out of nothing when they lend because they invent fictitious customer deposits. How do they do this? They simply redefine the promissory note that they have purchased from you (your loan) as a customer deposit but in reality nobody has deposited any money.

By inventing these claims on themselves (the fictitious deposits), banks create the money supply. This can be positive for the economy as long as the money creation is in line with new goods and services or implementation of new technologies. This is adding value to the economy and is funded by this money creation. It also means no inflation, the loans can be serviced and repaid, you have a stable economy and low inequality.

In countries that have banks that lend mainly for productive purposes (Germany or East Asia for example), inflation and inequality is significantly lower and the real economy booms.

If banks create credit for consumption you suddenly have more money created and more demand for goods but the same amount of goods and services remain. This creates inflation.

Even worse is if money creation is undertaken for financial transactions (e.g. asset transactions or purchasing ownership rights). As before, you are creating new money but no new goods or services. Instead you are giving somebody new purchasing power over existing assets. The result is asset price inflation and inequality. In the UK, this unproductive lending is dominant.

Professor Werner thinks that the whole Basel capital approach doesn’t work because it’s premised on the idea that banks are just financial intermediaries. They’re not, they’re money creators as has been outlined above. Bank regulation that recognises reality is needed.

According to the Professor, the only regulation that has ever worked at preventing asset bubbles and crises is guidance on bank credit. An example of this would be to simply ban bank credit for financial transactions. Speculators can still speculate but using their own money or borrowed money but not money created out of thin air. Allowing money creation for financial transaction creates asset bubbles and boom-bust cycles that, we the tax payer, end up paying for. This can also be achieved by having a banking system that is dominated by small, community banks, such as in Germany.

The Professor also delves into the enclave within the UK that is knows as the City of London (where the monarch must request permission to enter). He explains why the City couldn’t be part of the EU because it doesn’t have democratic elections as the banks have the voting power. For more information on this fact that most people are unaware of, read this article where I go into detail about how this works.